One complaint often logged against big chain stores such as Walmart, Target, or Kroger or, in the pharmacy space, CVS and Walgreens, is that they tend to squeeze out smaller, local stores. We refer to these as “Mom and Pop” businesses, as a reminder that many – though not all – are still family-run.

When it comes to pharmacies, unlike independent concerns in retail and grocery, Mom and Pop pharmacies are thriving. In fact, a recent study showed the number of independent pharmacies in the United States growing 12.9% from 2010 to 2019.

A study commissioned by Pharmaceutical Care Management Association (PCMA) in 2020 had several surprising findings:

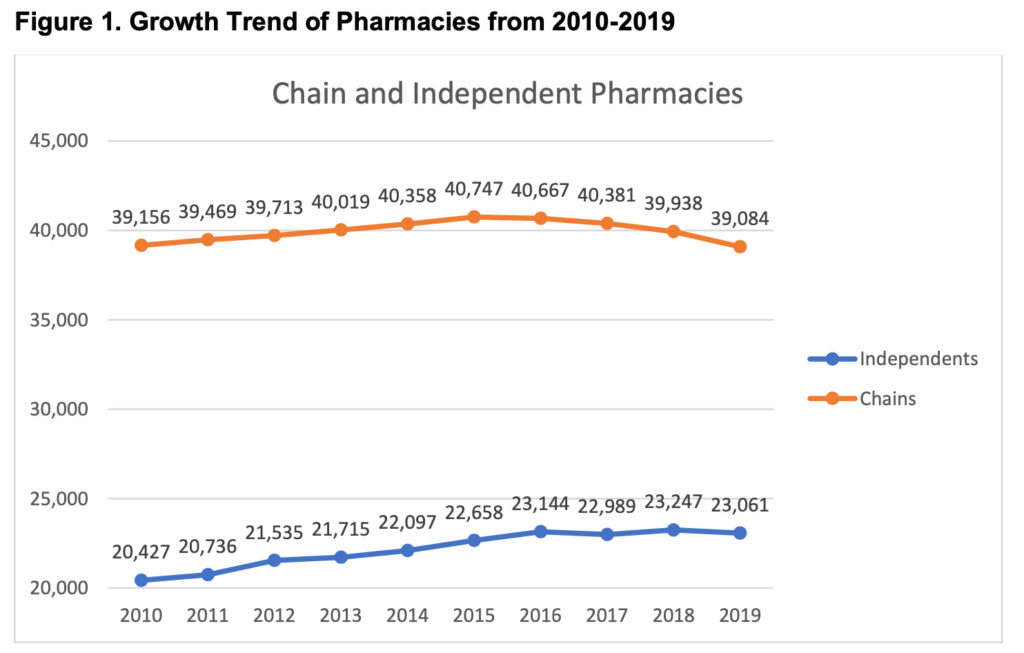

- In terms of the absolute change in the number of stores, independent pharmacies are faring better than chain pharmacies. Between 2010 and 2019, the number of independent pharmacies increased by more than 2,600 stores (12.9%), whereas chains lost around 80 stores (0.2%) on average.

- Longitudinal analyses (linear fixed-effects estimates) find that on average, states are enjoying an increase of six independent stores per year from 2010-2019.

- The relative growth in the number of independent stores at the state level is positively correlated to chain pharmacies. When chain pharmacies grow within a state, independent pharmacies also increase.

Are independent pharmacies growing or shrinking? Which is true?

Why are independent pharmacies growing? Did they not get the memo that they’re supposed to be withering away?

People love their independent pharmacies. They appreciate the high levels of service and attention from their pharmacists. This is not to say that chains don’t have their fans as well. But it does suggest that the growth in chain pharmacies does not necessarily portend doom for local independents.

So when we see headlines that say that the number of independent pharmacies is actually shrinking, we wonder how that can be. We see data from the National Council for Prescription Drug Programs, (NCPDP) that is the source of the reported growth cited above. During the same period, National Community Pharmacists Association, an advocate organization for independent pharmacies, cited year-over year drops in the count.

Which is right?

Independent pharmacies continue to serve their customers

As PCMA noted when addressing this seeming disparity, “These reports tend to focus on only one or two years and not the last decade, giving the impression of decline instead of annual fluctuations within a longer more positive trend.”

In other words, some years are better than others, but the news is far from dire for independent pharmacies.

PCMA reports: “A look at the trend by year over the last decade shows both chains and independents saw a steady rise of pharmacy growth from 2010-2015 (Figure 1). From 2016 forward, however, growth declined for chains while it plateaued for independents.”

“The data signal that independent pharmacies did not decline over the last decade but have enjoyed steady growth, and this growth has slowed only recently as the entire industry has slowed.”

Independent pharmacies aren’t dying, it turns out. Some are struggling, to be sure. Just as many other businesses in the United States have struggled since 2020. But many are doing well.

One thing’s for sure: If you love your local independent, they most certainly appreciate your continued patronage.